By Jordan Grim

Apple and Cohen & Steers have both wrapped up the third quarter of 2025 with stable results that show consistent financial performance despite ongoing market shifts. While Apple continues to balance innovation with sustainable earnings, Cohen & Steers remains focused on steady portfolio management and long-term investor value.

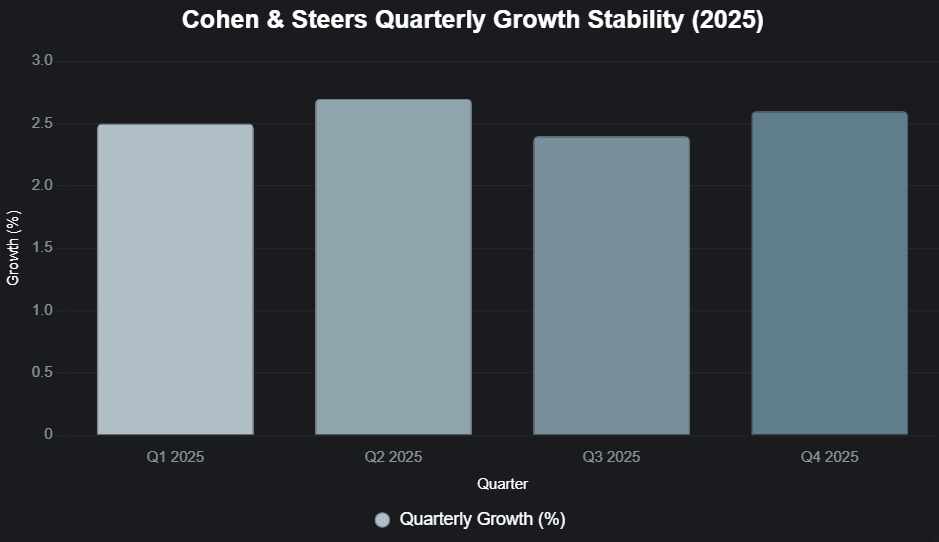

Cohen & Steers, headquartered in New York City, specializes in managing real assets such as real estate, infrastructure, and commodities. In its latest earnings release, the firm reported consistent quarterly growth, maintaining its strategy across global markets. The management team emphasized a continued commitment to diversification and disciplined investment—an approach that has kept the firm resilient through changing conditions.

According to investor reports, Cohen & Steers’ stock saw a modest improvement after the Q3 announcement. The company’s shares rose around 5% as strong net inflows and a focus on alternative income strategies gained investor attention. Although the firm’s one-year return remains down, its three- and five-year performance highlights long-term stability and trust from shareholders.

Meanwhile, Apple maintained steady performance through the same quarter. Despite a challenging tech environment, Apple’s focus on consistent innovation and service-based revenue has helped balance market pressure. Its ability to adapt product lines and maintain customer loyalty continues to support investor confidence.

Market analysts view both Apple and Cohen & Steers as well-positioned for the next phase of economic recovery. While short-term fluctuations may continue, both firms demonstrate strong fundamentals and practical management that appeal to investors seeking balanced growth.

As October 2025 ends, investors are watching how these companies handle the next quarter. With focus, patience, and stable leadership, Apple and Cohen & Steers appear ready to sustain their pace through the uncertain months ahead.